How to read a balance sheet

Don’t let the numbers dissuade you from digging into this essential information about your organization. Here’s how comms pros can make clear sense of these important documents.

[Editor’s Note: This is an excerpt from “Business Acumen for Strategic Communicators: A Primer.” You can purchase the book here and Ragan/PR Daily readers receive a 30% discount with the code BUSINESS30.]

While an income statement shows an organization’s revenues, expenses and the resulting profit or loss generated for the period under review, a balance sheet shows an organization’s assets (i.e., what it owns that is a source of value) and liabilities (i.e., what it owes) for a certain point in time.

The balance sheet also shows shareholders’ equity or net worth for the enterprise, which roughly indicates how much money would be left over for shareholders if the organization sold off all of its assets and paid off all of its liabilities. The name balance sheet comes from the fact that an organization’s total assets must equal or “balance” relative to the organization’s total liabilities plus shareholders’ equity. Balance sheets provide an important snapshot view of an organization’s financial staying power and ability (or inability) to endure significant disruptions to operations.

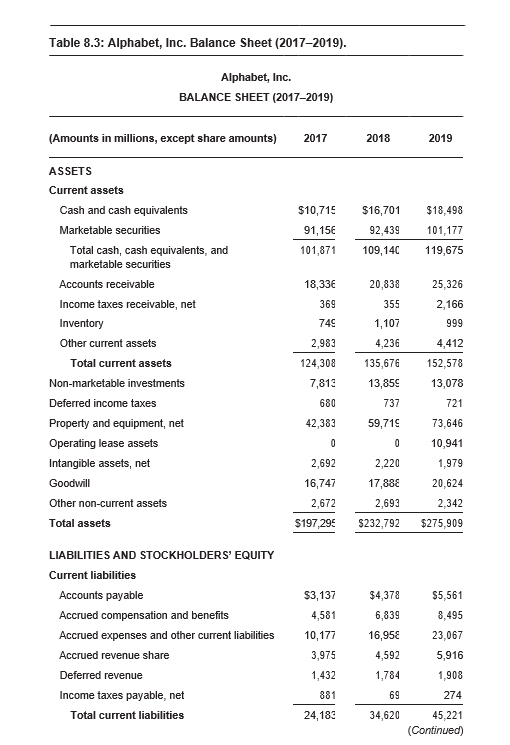

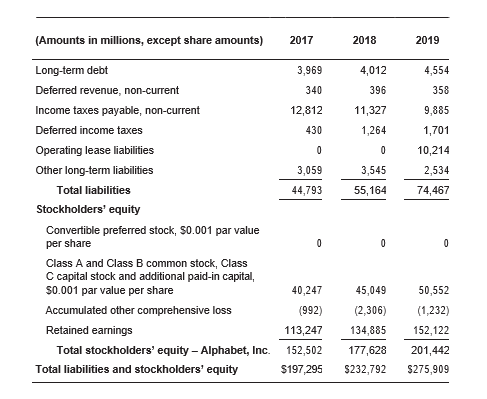

For example, at year-end fiscal 2019 (as shown in Table 8.3) Alphabet reported total assets of nearly $276 billion, a staggeringly large sum. There were corresponding liabilities and shareholders’ equity of the same amount (with total liabilities of nearly $74.5 billion and total stockholders’ equity of $201.4 billion). Stockholders’ equity less any preferred stock divided by the company’s total number of shares outstanding equals a company’s so-called “book value” per share.

Alphabet’s book value at year end was around $288.37 per share. Assuming the stated accounting values carried on a firm’s books are accurate, book value (also known as net book value or net asset value) theoretically represents the total value of a company’s assets that shareholders would receive if the company were to be liquidated.

Assets

An asset is something an organization owns that has value with the potential to generate revenues and contribute to profits. Examples of assets include cash, cash equivalents and marketable securities; accounts receivable (i.e., money owed to the organization); inventory; property, plant and equipment; operating leases; deferred income tax credits; intangible assets, such as copyrights, trademarks and patents; and goodwill, an intangible asset that accounts for the excess purchase price of another company’s assets. Current assets are assets the organization may convert to cash typically in a year or less, while non-current assets are longer-term assets. As shown in Table 8.3, at year-end 2019, Alphabet reported total current assets of nearly $152.6 billion and non-current assets of approximately $123.3 billion.

The current assets section of the balance sheet, specifically the cash, cash equivalents and marketable securities lines, is also used to calculate an organization’s “burn rate” (also called its “cash burn”) and to assess the general health of its balance sheet. The burn rate is the rate at which a money-losing organization spends its cash on hand and other readily available assets over a certain period of time (such as on a monthly or even a weekly basis) to cover its operating expenses.

During the coronavirus outbreak and economic slow-down, there was a heightened interest by stakeholders in the cash balances and burn rates of every type of enterprise, from small startup companies to multinational corporations. In the case of Alphabet, as of year-end 2019, it had a fortress-like balance sheet with a staggering $119.7 billion in cash, cash equivalents and marketable securities on hand.

Liabilities

A liability is, as the name implies, some sort of monetary obligation that the organization owes to someone else and for which it is liable. Examples of liabilities include accounts payable (i.e., money the organization owes to suppliers and vendors); income taxes payable or deferred; accrued and deferred revenues; long-term debt; operating lease liabilities; and other long-term liabilities. Long-term debt may include debts owed to banks, bondholders or other parties. Current liabilities are liabilities that the organization expects to pay within a year, while non-current liabilities have an expected payback duration of beyond a year. Typical non-current liabilities include long-term debt and long-term lease obligations.

As shown in Table 8.3, at year-end 2019, Alphabet reported total current liabilities of approximately $45.2 billion and non-current liabilities of approximately $29.2 billion.

Shareholders’ equity

Shareholders’ equity, also called stockholders’ equity, is the remaining amount of assets available to an organization’s shareholders after all liabilities have been paid.

Shareholders’ equity comes from two main sources: the amount of money originally and subsequently invested in the company, and through retained earnings, which the firm accumulates over time as it generates profits. A company with negative shareholders’ equity (i.e., liabilities exceed assets) may indicate it is at risk of bankruptcy. Company boards and management teams generally seek to increase the value of shareholders’ equity over time.

Alphabet’s shareholders’ equity consistently grew from 2017 to 2019. As shown in Table 8.3, Alphabet reported shareholders’ equity of approximately $201.4 billion at year-end fiscal 2019. This compares with shareholders’ equity of around $177.6 billion and $152.5 billion in fiscal 2018 and 2017, respectively.

Matt Ragas is an associate professor of public relations and corporate communications at DePaul University. Ron Culp is the professional director of the graduate PR and advertising program at DePaul University.