The risks and rewards of pursuing ESG priorities

Companies that act in an ethical, responsible manner can create a huge advantage in recruiting, retention and sales. An expert shares how to pursue meaningful, sustainable programs.

As feather-haired Andre Agassi boldly stated in a bygone era: “Image is everything.”

That’s still kind of true. But a more precise update for 2021 would be: “Reputation is everything.”

Jessie Sitnick, VP of corporate and public affairs at Toronto-based Argyle, shared a wealth of tremendous guidance with Ragan’s Crisis Leadership Network members on the perils and benefits of pursuing an Environmental, Social and Governance (ESG) plan. Sitnick, who previously spent a decade in the environmental sector, says her career has largely focused on the “E” in ESG. But that’s just one ingredient in a much larger strategic stew.

To begin, she clarified the difference between ESG, CSR and corporate philanthropy. They’re all similar—and certainly related—but important distinctions include:

While corporate philanthropy and CSR likely have a “home” in your company, and someone who “owns” each initiative, ESG falls to the board, the C-suite and everywhere else throughout your company. ESG strikes to the root of your reputation and how you’re perceived by the outside world—and by those within your walls. “Who you are is more important than what you sell,” Sitnick says, adding, “You must invest in relationships that drive your reputation.” Otherwise, you risk losing precious talent and capital.

ESG in action

Sitnick references Coca-Cola as a prime example of a company using ESG to build a better, more sustainable business.

The soda giant was no stranger to philanthropy and CSR programs meant to “decouple growth from harm,” as Sitnick puts it. But in the early aughts, Coke started taking heavy PR fire for its impact on local environments around the world. More specifically, the company was receiving sharp backlash for continuing to guzzle fresh water resources in places experiencing severe droughts and water insecurity to make its beverages.

Faced with a set of issues that threatened the future of its business around the globe, it had to act fast. And meaningfully. Without water, there’s no Coke, right? So in 2007, Coca-Cola launched the Replenish campaign, which pledged to “return the equivalent amount of water used in finished beverages to nature and communities by 2020,” claiming: “For every drop we use, we give one back.”

Coke announced that it hit that goal in 2016. And it’s still going. Why? It’s more than good PR.

“Coke understands that fresh water abundance is a core issue to its long-term sustainability,” Sitnick says. She also notes that ESG is a journey. It requires a long-term commitment of working toward solutions to healthier, more ethical business practices. There are no quick fixes for this sort of work.

Again citing Coca-Cola’s water stewardship program, Sitnick notes that it evolved from a localized CSR initiative to a larger ESG campaign that’s gone from merely “giving back” to “creating value.” In recent years, Coke has created a Global Social Justice Framework, set a new target to reduce single-use plastics, and a goal to achieve net-zero carbon emissions by 2050. The company has also pivoted from plant-based bottles to producing 100% recycled bottles in the U.S. and continues to receive a respectable ESG rating.

Sitnick notes that issues pertaining to climate, water and carbon emissions are all tied up together, which requires a complex, thoughtful response. For a robust ESG framework, Sitnick advises:

- Invest in disruptive solutions that go beyond boilerplate objectives.

- Align with global targets (such as the N.’s Sustainable Development Goals)

- Continually advance knowledge, and pivot priorities as needed.

- Integrate risk into disclosure.

Why ESG?

You might be saying to yourself, “My company is not as big as Coke.” Regardless of your organization’s size or objectives, Sitnick says it’s smart to ask: “If we don’t act, how does it put our company at risk?” She offers four more reasons to care about ESG moving forward:

- Your investors care.

- Your governments and regulators care.

- Your customers care.

- Your employees care.

Expounding upon those reasons, Sitnick cites more data to push for embracing ESG initiatives:

- According to Blackrock, 2020 saw a 96% increase in sustainable investing. CNBC says that despite the pandemic, sustainable investing is “surging.”

- Marsh & McLennan found that the most “attractive” employers for young talent have ESG scores 25% higher than the global average.

- Deloitte has found that Millennials and Gen Zers “punish” businesses that don’t align with their values.

- As McKinsey writes, “ESG helps companies reduce the risk of adverse government action. It can also engender government support.”

Embracing ESG initiatives can help you get ahead of new regulations, too, such as California’s new board diversity rules. Of course, acting in an ethical, responsible manner is the right thing to do and advisable at all times—but it’s also good for business.

Reputational risks to confront

Pursuing an ESG program is not without risk—and neither is ignoring ESG considerations altogether. Sitnick cites three types of reputational pitfalls to beware:

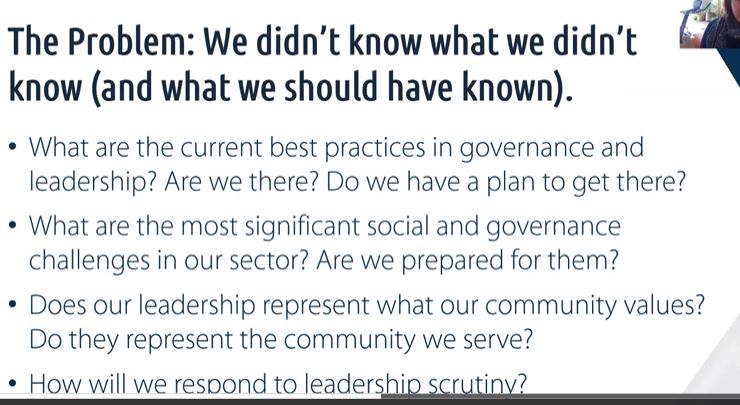

Risk of appearing irrelevant or out of touch. Sitnick cites WeWork’s board diversity fiasco, which flared up amid its ballyhooed IPO announcement.

She offers these takeaways from WeWork’s debacle:

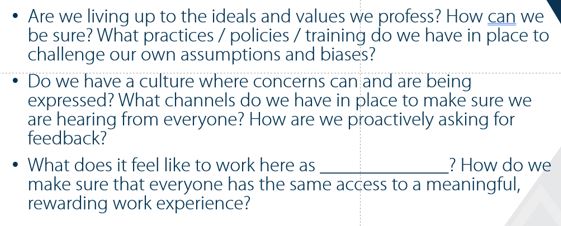

Risk of appearing hypocritical or not credible. Sitnick uses the example of Everlane to illustrate this pitfall. The fashion company, which touted its culture of “radical transparency,” endured a firestorm of criticism from former employees who said the company’s ethical image was all an act, a phony illusion.

Coca-Cola has struggled on this front, too. The Verge published an investigation into Coke’s claims and found they were “not even close” to meeting the lofty goals they claimed to have achieved. The lesson here: Be careful with your wording and your claims—and your math, too. Sitnick suggests asking hard questions, such as:

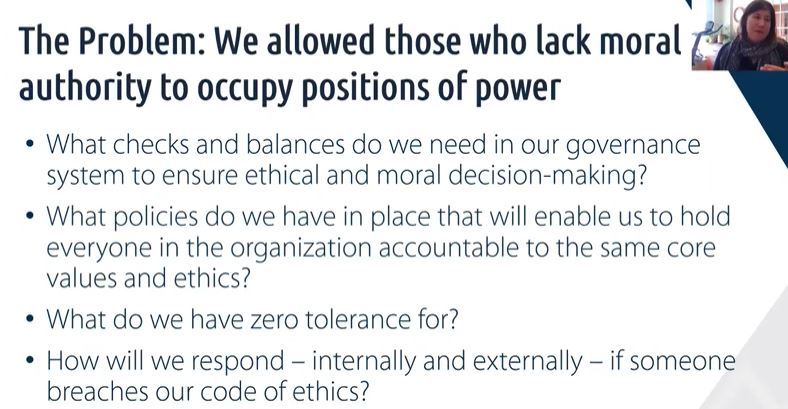

Risk of being demonized or uncaring. Sitnick shares about a Toronto theater owner who faced serious backlash in the media and the community due to an ugly racial profiling incident. The story was local, but that problem knows no geographical bounds. Sitnick’s slide sheds light on this subject:

So, what’s a communicator’s role in all this? As Sitnick notes, it’s easy to get overwhelmed by all the pressing issues of our age: climate change, mental health, DE&I, board diversity—oh, and COVID. But hope and opportunity are absolutely bursting at the seams. As Sitnick says, the world of ESG is still so young, and evolving, which means we can play a key role in crafting what ESG policy looks like. We can be the ones who shape ESG strategy and craft the future of corporate ESG programs. To summarize her point, Sitnick quotes Canadian geographer Karen Bakker: “Crisis, in the true sense of the word, is a turning point in which weaknesses are exposed, challenges are confronted, and opportunities for innovation arise.”

That’s where we are right now, and that’s what ESG is.

Where to start?

Sitnick says it all comes back to purpose and relationships. Citing Larry Fink’s 2021 letter to CEOs:

“It is clear that being connected to stakeholders – establishing trust with them and acting with purpose – enables a company to understand and respond to the changes happening in the world. Companies ignore stakeholders at their peril – companies that do not earn this trust will find it harder and harder to attract customers and talent, especially as young people increasingly expect companies to reflect their values. The more your company can show its purpose in delivering value to its customers, its employees, and its communities, the better able you will be to compete and deliver long-term, durable profits.”

She offers six steps to start your ESG journey:

1. Revisit (reimagine) your purpose. Define the values and core principles that guide you.

2. Adopt a learner’s mind. Start from humility and courage.

3. Survey your landscape. Benchmark against the leaders you admire.

4. Understand your stakeholders’ expectations. That goes for internal and external.

5. Commit to a journey. Including tangible milestones.

6. Communicate intention, action and progress. Adopt a cadence that will keep you accountable. Be sure to include ESG updates in your financial reporting.

Over to you, communicators. Is your company pursuing ESG objectives? If so, how’s it going? Please elaborate in the comments below. And to glean more sharp insights from top industry experts, join Ragan’s Crisis Leadership Network.